Green Bonds: Can Corporate Financing Drive Real Carbon Cuts?

- Vanessa

- Nov 14, 2025

- 6 min read

By Vanessa (Research Analyst, UCL Green Economy Society)

Over the past decade, technology and financial firms have come under mounting pressure to cut greenhouse gas emissions while still delivering for investors. In response, many have turned to green bonds, which are debt instruments earmarked to finance projects with clear environmental benefits, such as renewable energy or energy efficiency upgrades. Issued by corporations, governments, or financial institutions, these bonds raise capital from investors who seek both returns and measurable climate impact.

In this competitive landscape, green bonds have become a key lever for sustainable finance, directing billions into low-carbon initiatives while boosting corporate accountability. Leading issuers such as Apple and HSBC have tied their bond programs to tangible outcomes, requiring detailed disclosure of emissions data, project milestones, and sustainability targets [5][7].

Apple, for instance, has made renewable energy central to its decarbonization strategy, reaching 13.7 gigawatts of clean power capacity across its supply chain by 2023 [1]. The company’s efforts extend beyond its own operations, incentivizing hundreds of suppliers to switch to renewables. HSBC, meanwhile, has channelled green bond proceeds into projects across emerging markets—from solar and wind power to climate-resilient infrastructure [3]. Together, these examples show how green bonds have evolved beyond a niche funding tool into a cornerstone of corporate sustainability strategy.

Green Bonds: Driving Environmental and Social Outcomes

The environmental impact of green bonds is evident in the projects financed through these instruments. Apple, for instance, has invested in solar and wind developments that cut emissions across its global supply chain while boosting energy efficiency [1]. HSBC’s green bond programs target projects with measurable social and environmental benefits, ranging from improving access to clean water to supporting sustainable urban infrastructure [3][4].

Unlike traditional debt financing, green bond issuers are required to provide detailed disclosures on project progress, fund allocation, and emissions reductions. This framework fosters greater accountability and transparency across industries. Beyond environmental gains, the green bond process itself drives stronger governance: issuers must document how proceeds are used, monitor project milestones, and evaluate performance outcomes. Such oversight sharpens management’s focus on sustainability goals and aligns investor and corporate incentives with long-term ESG priorities.

Academic research supports these observations. Xiong, Zhang, and Mao (2025) emphasize that green bonds not only finance low-carbon projects but also systematically improve ESG performance, aiding firms in optimizsing environmental practices, governance structures, and social initiatives [5]. Similarly, Khan and Vismara (2025) conducted a meta-analysis demonstrating that green bonds consistently yield positive ecological outcomes, although their financial impact can vary across metrics and regional factors. The combination of practical corporate experience and empirical evidence highlights the transformative potential of green bonds when used strategically.

Green Bonds: Focus on Apple and HSBC

Apple and HSBC illustrate two distinct approaches to green bonds. Apple invests directly in renewable energy across its operations and supply chain, achieving measurable reductions in emissions. HSBC uses green bonds to finance external sustainability projects, particularly in emerging markets, acting as a capital conduit rather than a direct emitter reducer. Both show that green bonds can drive real-world environmental impact, not just signal corporate intentions.

Data Insights: Green Bond Allocation and Decarbonization Pathways

Figures 1 and 2 illustrate how Apple and HSBC embody two distinct sustainable finance philosophies.

Apple’s green bond allocation demonstrates a focused, technology-driven strategy (Figure 1). From 2020 to 2024, it allocated a total of $330 million to $1 billion in proceeds to renewable energy, which is the largest portion, while the rest supported energy efficiency, carbon mitigation, and low-carbon design. By investing in clean energy innovation and circular design, Apple uses bond proceeds as a tool for systemic decarbonizsation across its operations and supply chain.

HSBC’s allocation highlights diversity (Figure 2). From 2019 to 2024, its total green bond funding increased from $2.1 billion to $6 billion, supporting renewable energy, green buildings, clean transportation, energy efficiency, and sustainable waste projects. The bank serves as a financial intermediary, expanding sustainability by channeling capital to various projects worldwide.

Together, the two models show the versatility of green bonds: Apple turns capital into immediate emission reductions, while HSBC enhances impact through systemic leverage. Their design and deployment reflect not only financial capacity but also institutional identity, shaping how green finance turns into measurable climate action. These contrasting pathways echo academic findings that investors perceive both corporate and financial green bonds as comparable in credibility and environmental risk exposure [7].

Emission and Energy Outcomes Post–Green Bond Issuance

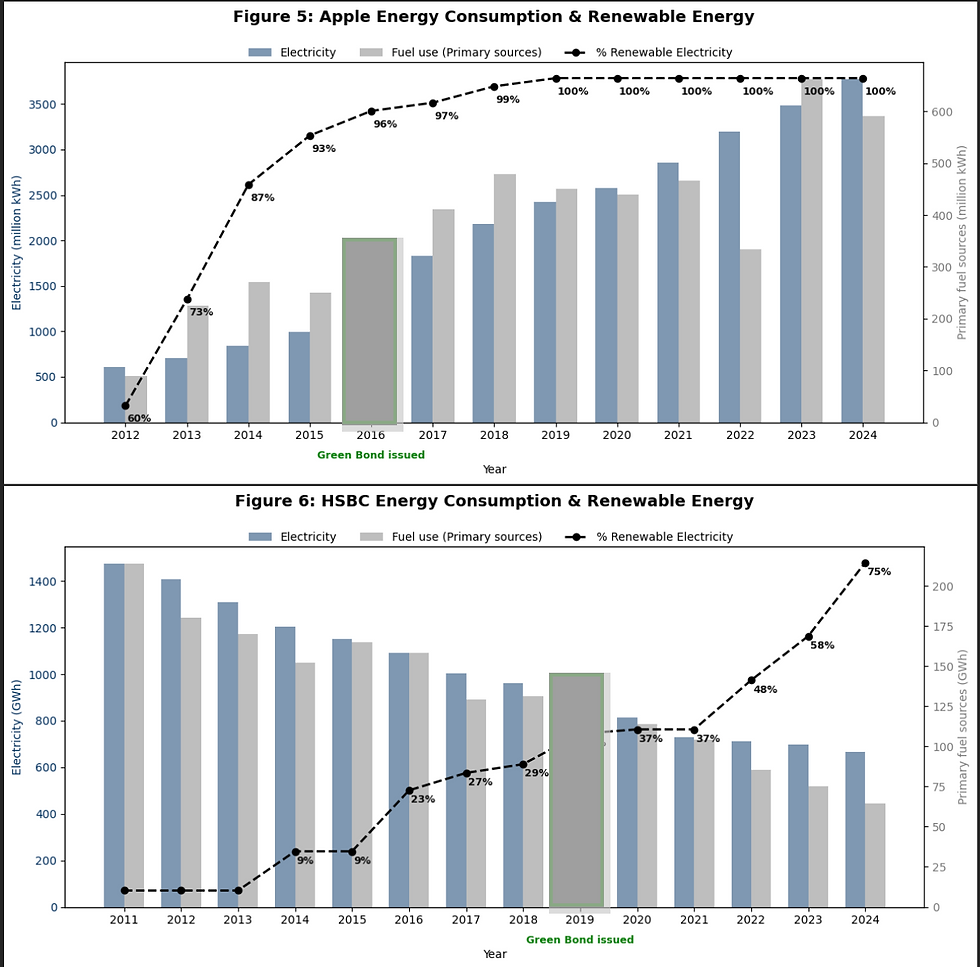

The environmental impact of these allocation patterns becomes evident when examining the evolution of emissions and energy consumption across both issuers (Figures 3–6).

Apple’s decarbonizsation story (Figure 3) began a new chapter in 2016 with the issuance of its first green bond. From 2012 to 2024, Apple’s Scope 1 and 2 emissions decreased by nearly two-thirds, marking a significant shift driven by its aggressive push toward renewable energy and energy-efficiency initiatives. The company achieved 100% renewable power for global operations by 2018 [1]. While total electricity consumption has increased due to growing production capacity, its reliance on natural gas has steadily declined. This trend demonstrates how Apple’s bond-funded projects have effectively decoupled business growth from fossil fuel use. Notably, reported emissions slightly rose after 2018, not due to regression but because of an expanded accounting boundary that now includes backup power and remote work emissions. Even with this broader scope, Apple’s footprint still reflects genuine, sustained emission reductions.

HSBC’s trajectory (Figure 4) depicts a steadier but consistent pattern. Since launching its green bond program in 2018, the bank has gradually lowered its Scope 1 and 2 emissions, driven by efficiency upgrades and investments in low-carbon infrastructure, especially in emerging markets. These efforts align with partnerships such as the one with the International Finance Corporation, which seeks to channel capital into sustainable projects in developing economies [3]. However, its Scope 3 emissions from financed activities have continued to increase. Although challenging, this rise reflects HSBC’s decision to expand its reporting scope, providing a more comprehensive view of its indirect climate impact. Nonetheless, the bank’s operational emissions continue to decline, indicating that its facilities and energy systems are on a cleaner path.

Energy consumption data (Figures 5 and 6) further underscore the divergence between the two models. Apple’s energy mix (Figure 5) reveals an early and decisive transition: renewable electricity rose from 60% in 2012 to 100% in 2018, even as total energy demand grew. HSBC’s transition (Figure 6) began later but shows steady progress, from a near-zero renewable baseline in 2013 to roughly 75% by 2024, alongside reductions in both electricity and natural gas use. The difference reflects structural realities: Apple directly controls its operational footprint, while HSBC’s decarboniszation influence is indirect, mainly expressed through the capital it allocates.

As the energy transition accelerates, these case studies show that corporations and financial institutions can each leverage green finance to align growth with measurable climate outcomes, though their paths toward decarbonization remain fundamentally different.

Investor Perspectives and Market Response

Markets don’t always reward companies for going green. When firms announce new green bond issuances, investors often hesitate, balancing environmental goals against short-term profits. A study by Lebelle, Jarjir, and Sassi (2020) found that stock market reactions to green bond announcements were slightly negative, with cumulative abnormal returns ranging from –0.5% to –0.2% [7]. The decline reflects early-stage skepticism: green financing has long been linked with longer payback periods and execution risks, even when the strategic reason is clear.

That narrative, however, is starting to change. Transparency now sets the standard for credibility. Both Apple and HSBC have improved their carbon accounting methods, including sources like R&D energy use and backup power generation, which can make year-to-year comparisons more complex but also increase accuracy. For investors, the emphasis has shifted from single-year emission results to the reliability and consistency of disclosures over time.

The so-called greenium, a small yield discount investors accept in exchange for credible sustainability commitments, is now emerging as a sign of confidence rather than a concession. It shows that the market is starting to price environmental governance as a proxy for long-term operational resilience. As transparency grows and performance data become more robust, green bonds are shifting from a niche sustainability tool into a mainstream financial standard, one that links capital allocation more directly to measurable decarbonization results.

References

Apple Inc. (2023, April 19). Apple and global suppliers expand renewable energy to 13.7 gigawatts. Apple Newsroom. https://www.apple.com/newsroom/2023/04/apple-and-global-suppliers-expand-renewable-energy-to-13-point-7-gigawatts

Apple Inc. (2024, April). Apple ramps up investment in clean energy and water around the world. Apple Newsroom. https://www.apple.com/uk/newsroom/2024/04/apple-ramps-up-investment-in-clean-energy-and-water-around-the-world

HSBC Holdings plc & International Finance Corporation. (2024). IFC and HSBC asset management expand partnership to support sustainability in emerging markets. https://www.ifc.org/en/pressroom/2024/ifc-and-hsbc-asset-management-expand-partnership-to-support-sustainability-in-emerging-markets

Environmental Finance. (2025). Sustainable Debt Awards 2025: Lead Manager of the Year – Green Bonds. https://www.environmental-finance.com/content/awards/environmental-finances-sustainable-debt-awards-2025/winners/lead-manager-of-the-year-green-bonds-financial-institution-lead-manager-of-the-year-sustainability-bonds-corporate-hsbc.html

Xiong, B., Zhang, C., & Mao, Y. (2025). A Study on the Impact of Green Bonds on Corporate ESG Performance. Journal of Sustainable Finance.

Khan, M., & Vismara, S. (2025). Green bond issuance and corporate environmental and financial performance: A meta-analysis. Environmental and Energy Economics Journal.

Lebelle, J., Jarjir, S., & Sassi, H. (2020). Corporate Green Bond Issuances: An International Evidence. Finance Research Letters.

Comments